What Does Business Debt Collection Mean?

Wiki Article

6 Simple Techniques For Private Schools Debt Collection

Table of ContentsNot known Facts About International Debt CollectionGetting My Debt Collection Agency To WorkFascination About Business Debt CollectionDebt Collection Agency for Dummies

The debt purchaser acquires only an electronic documents of info, frequently without supporting evidence of the financial debt. The financial debt is also typically really old debt, often described as "zombie debt" due to the fact that the financial debt buyer attempts to restore a debt that was past the law of restrictions for collections. Debt collection agencies may contact you either in creating or by phone.

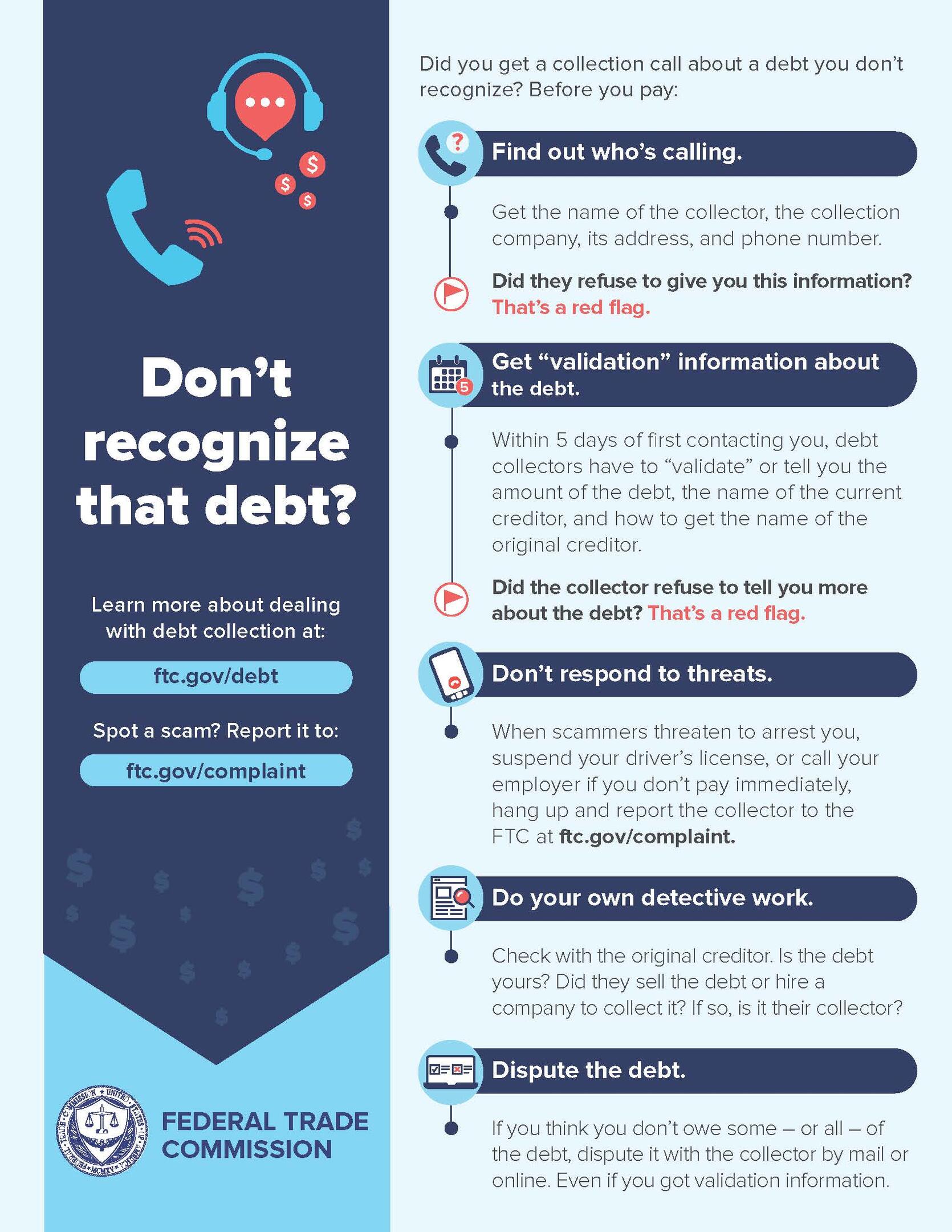

But not speaking to them will not make the financial debt disappear, as well as they might just attempt alternative techniques to call you, including suing you. When a debt collection agency calls you, it is necessary to get some first information from them, such as: The debt enthusiast's name, address, as well as telephone number. The total amount of the financial debt they claim you owe, including any type of costs as well as rate of interest fees that might have accrued.

:max_bytes(150000):strip_icc()/debt-validation-requires-collectors-to-prove-debts-exist-960594-V1-a13dc2e2066f49c38ebc05f515de9492.jpg)

Private Schools Debt Collection Things To Know Before You Buy

The letter has to state that it's from a financial obligation enthusiast. Call as well as attend to of both the financial obligation collector and also the borrower. The financial institution or creditors to whom the financial debt is owed. An itemization of the financial debt, including charges and rate of interest. They need to also educate you of your civil liberties in the debt collection process, and just how you can contest the financial obligation.If you do challenge the financial debt within 1 month, they have to discontinue collection initiatives till they provide you with proof that the financial obligation is yours. They must give you with the name and address of the initial lender if you request that details within one month. The debt validation notice must include a kind that can be used to contact them if you want to contest the financial debt.

Some points financial debt enthusiasts can not do are: Make duplicated telephone calls to a debtor, planning to frustrate the borrower. Normally, unsettled debt is reported to the credit history bureaus when it's 30 days past due.

If your financial obligation is transferred to a financial obligation visit the website enthusiast or sold to a debt buyer, an entry will certainly be made on your credit history record. Each time your financial debt is marketed, if it proceeds to go overdue, one more entry will certainly be added to your credit scores report. Each unfavorable entry on your credit score report can stay there for as much as seven years, also after the financial debt has actually been paid.

10 Easy Facts About Dental Debt Collection Shown

What should you expect from a collection company and just how does the procedure job? Continue reading to discover. As soon as you have actually made the choice to employ a debt collector, ensure you select the right one. If you comply with the advice listed below, you can be confident that you have actually worked with a respectable firm that will certainly handle your account with care.For example, some are better at obtaining arise from bigger services, while others are proficient at collecting from home-based organizations. Ensure you're collaborating with a company that will in fact serve your demands. This might appear apparent, however prior to you hire a collection firm, you require to guarantee that they are certified and accredited to function as financial obligation collectors.

Before you start your search, recognize the licensing needs for debt collection agency in your state. That method, when you are talking to agencies, you can speak smartly regarding your state's needs. Talk to the firms you talk with to guarantee they satisfy the licensing demands for your state, specifically if they are situated in other places.

You need to likewise examine with your Bbb and the Business Debt Collection Agency Organization for the names of reliable and also very concerned debt collectors. While you might be passing along these financial debts to a collection agency, they are still representing your business. You require to understand just how they will YOURURL.com represent you, exactly how they will deal with you, and also what appropriate experience they have.

The 25-Second Trick For Business Debt Collection

Just since a tactic is lawful does not indicate that it's something you desire your firm name related to. A trusted financial debt enthusiast will deal with you to outline a plan you can cope with, one that treats your previous customers the way you 'd wish to be treated as well as still does the job.If that takes place, one tactic several firms use is avoid mapping. That means they have access to specific data sources to aid check here find a debtor that has left no forwarding address. This can be an excellent technique to ask concerning especially. You ought to also go into the collector's experience. Have they worked with companies in your industry before? Is your circumstance outside of their experience, or is it something they recognize with? Pertinent experience boosts the likelihood that their collection initiatives will achieve success.

You must have a factor of contact that you can interact with and also receive updates from. Business Debt Collection. They must be able to plainly verbalize what will certainly be expected from you at the same time, what details you'll need to supply, as well as what the cadence as well as causes for communication will certainly be. Your chosen company should have the ability to accommodate your selected communication needs, not require you to approve their own

Despite whether you win such a case or not, you wish to make certain that your business is not the one on the hook. Request evidence of insurance policy from any debt collection agency to shield on your own. This is most typically called a mistakes as well as noninclusions insurance coverage. Debt collection is a solution, as well as it's not an economical one.

Report this wiki page